Legal fees in Malaysia; When it comes to purchasing a home in Malaysia, there are several costs involved beyond the price of the property itself. One of these additional costs is legal fees, which play a crucial role in ensuring that your property transaction is legally sound and secure.

In this article, we will explore what legal fees are, how they are calculated, and the exciting budget 2023 stamp duty exemption for your first home.

What Are Legal Fees?

Legal fees are charges incurred for legal services rendered during a property transaction. These services include drafting and reviewing legal documents, conducting property searches, and ensuring that the property’s title is transferred accurately to the buyer. Legal fees are typically paid to a qualified lawyer or a law firm.

How Are Legal Fees Calculated?

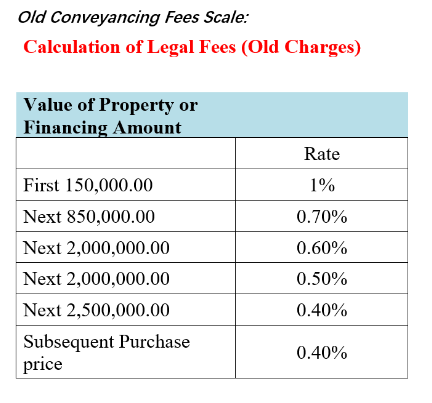

The calculation of legal fees in Malaysia is based on a structured scale prescribed by the Solicitors’ Remuneration Order 2005. The scale provides a clear and standardized method for determining the legal fees for property transactions.

The legal fees are calculated as a percentage of the property’s purchase price. The current scale of fees for the sale and purchase agreement is as follows:

- For the first RM500,000 of the purchase price: 1%

- For the next RM500,001 to RM2,000,000: 0.8%

- For the subsequent amount exceeding RM2,000,000: 0.7%

Let’s break down this calculation with an example:

Suppose you are purchasing your first home for RM600,000. Here’s how the legal fees would be calculated:

- For the first RM500,000: 1% x RM500,000 = RM5,000

- For the next RM100,000 (RM600,000 – RM500,000): 0.8% x RM100,000 = RM800

So, the total legal fees for this property transaction would be RM5,800.

Budget 2023 Stamp Duty Exemption for Your First Home

In Malaysia, the government has taken steps to ease the financial burden on first-time homebuyers. One such initiative is the stamp duty exemption for your first home, which was introduced in the Budget 2023.

Stamp duty is a tax imposed on various documents related to property transactions. It is an essential component of the property purchase process. However, the Malaysian government recognizes the significance of homeownership, especially for first-time buyers, and has introduced this exemption to make it more affordable.

Under the Budget 2023 stamp duty exemption, first-time homebuyers are eligible for a full stamp duty exemption on the instruments of transfer and loan agreement for properties priced up to RM500,000. This is excellent news for those looking to step onto the property ladder.

Here’s what this exemption means for you:

- Instruments of Transfer: This document relates to the transfer of ownership from the seller to the buyer. With the exemption, you won’t have to pay any stamp duty on this document if your property is priced up to RM500,000.

- Loan Agreement: The loan agreement is crucial when you’re financing your home purchase through a loan. The exemption applies to this document as well, saving you more money in the process.

It’s important to note that this stamp duty exemption is a limited-time offer, and its availability may vary based on government policies. Therefore, if you’re a first-time homebuyer planning to take advantage of this exemption, it’s essential to stay updated on the latest announcements and eligibility criteria.

Additional Considerations

While legal fees and stamp duty exemption for your first home are significant factors to consider in your property purchase, there are other costs associated with buying a home. These may include:

- Real Property Gains Tax (RPGT): This tax may apply if you sell your property within a certain period after purchase. The rate varies depending on the holding period.

- Valuation Fees: You may need to pay for a property valuation report, especially if you’re applying for a home loan.

- Insurance: Consider getting mortgage insurance to protect your home in case of unforeseen events.

- Miscellaneous Costs: These may include costs for utility transfers, renovation, and maintenance.

In Summary

Legal fees and stamp duty exemption are essential aspects of the property purchase process in Malaysia. Understanding how these fees are calculated and being aware of government incentives like the Budget 2023 stamp duty exemption for your first home can significantly impact your decision-making process when buying a property.

It’s advisable to consult with a qualified lawyer or a property expert to ensure that you fully comprehend all the costs involved in your property transaction. With the right knowledge and guidance, you can navigate the property market more confidently and make informed decisions regarding your first home purchase in Malaysia.

Related post:

Leave a Reply

View Comments