Legal fees calculator malaysia; Buying or transferring property in Malaysia involves various legal and financial considerations, including legal fees and stamp duty. These costs can significantly impact your property transaction.

In this guide, we will break down the legal fees and stamp duty for sale and purchase agreements, property transfers, and loan agreements in Malaysia for the year 2023.

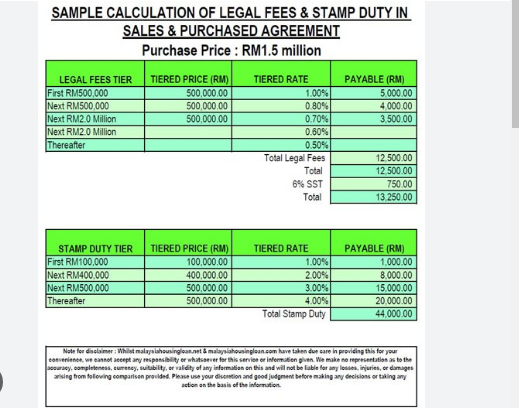

Table of Legal Fees and Stamp Duty Rates

Below is a table summarizing the legal fees and stamp duty rates for different property transaction scenarios in Malaysia:

| Property Transaction Value (RM) | Legal Fees (Sale and Purchase Agreements) | Stamp Duty (Transfers of Property) |

|---|---|---|

| Up to RM500,000 | 1.25% (Minimum fee of RM500.00) | 1% (First RM100,000) |

| 2% (RM100,001 to RM500,000) | ||

| RM500,001 to RM7,000,000 | 1% | 3% (RM500,001 to RM1,000,000) |

| Exceeding RM7,500,000 | Subject to negotiation on excess but not exceeding 1% of excess | 4% (Above RM1,000,000) |

Understanding Legal Fees

Legal fees for sale and purchase agreements in Malaysia are calculated based on the property transaction value. Here’s a breakdown:

1. Up to RM500,000:

- Legal fees are 1.25% of the transaction value.

- A minimum fee of RM500.00 applies. If 1.25% of the purchase price is less than RM500.00, you’ll still need to pay the minimum fee.

2. RM500,001 to RM7,000,000:

- For properties valued above RM500,000 but up to RM7,000,000, the legal fee is a flat 1% of the transaction value.

3. Exceeding RM7,500,000:

- Properties valued above RM7,500,000 have legal fees subject to negotiation on the excess amount. However, the fee should not exceed 1% of the excess value.

Understanding Stamp Duty

Stamp duty is another significant cost associated with property transactions in Malaysia. The stamp duty rate varies based on the property transaction value. Here’s how it works:

1. Up to RM100,000:

- Stamp duty is 1% of the transaction value for the first RM100,000.

2. RM100,001 to RM500,000:

- For the portion of the transaction value between RM100,001 and RM500,000, the stamp duty rate is 2%.

3. RM500,001 to RM1,000,000:

- If the property’s value falls between RM500,001 and RM1,000,000, the stamp duty rate is 3%.

4. Above RM1,000,000:

- Properties with a transaction value exceeding RM1,000,000 are subject to a stamp duty rate of 4%.

Putting It All Together

Let’s illustrate how legal fees and stamp duty work with an example:

Suppose you are purchasing a property with an adjudicated value of RM800,000. Here’s how you would calculate the legal fees and stamp duty:

Legal Fees:

- For the first RM500,000, the fee is 1.25% or RM6,250.00 (subject to a minimum of RM500.00).

- The subsequent RM300,000 is charged at 1%, which amounts to RM3,000.00.

- The total legal fee is RM6,250.00 + RM3,000.00 = RM9,250.00.

Stamp Duty:

- The first RM100,000 is charged at 1%, which amounts to RM1,000.00.

- The remaining RM700,000 falls within the range of RM100,001 to RM500,000, and is charged at 2%, which amounts to RM14,000.00.

- The total stamp duty is RM1,000.00 + RM14,000.00 = RM15,000.00.

In this example, the combined legal fees and stamp duty for a property valued at RM800,000 would be RM9,250.00 + RM15,000.00 = RM24,250.00.

Conclusion

Understanding legal fees and stamp duty is essential when engaging in property transactions in Malaysia. These costs are determined based on the property’s transaction value and can vary significantly.

It’s crucial to budget for these expenses to ensure a smooth and financially sound property transaction. Additionally, it’s advisable to consult with legal professionals or government authorities for the most up-to-date information on legal fees and stamp duty, as these rates may change over time.

Related post:

Leave a Reply

View Comments