Legal fees calculator in Malaysia; When it comes to buying or selling property in Malaysia, understanding the legal fees and stamp duty involved is essential. These fees are a crucial part of property transactions and can significantly impact your budget.

In this blog post, we will simplify the complex world of legal fees and stamp duty calculations in Malaysia, making it easier for you to navigate your property transactions.

Legal Fees for Sale and Purchase Agreements / Transfers of Property / Loan Agreements

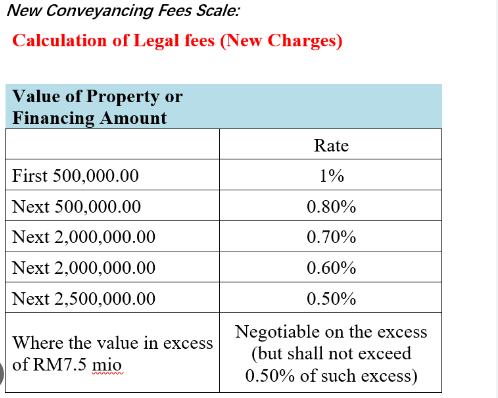

Let’s begin by examining the legal fees for sale and purchase agreements, property transfers, and loan agreements. The fees are typically calculated based on the purchase price or adjudicated value of the property. Here’s a breakdown:

| Purchase Price or Adjudicated Value | Scales of Fees |

|---|---|

| For the first RM500,000 | 1.25% (subject to a minimum fee of RM500.00) |

| Subsequent RM7,000,000.00 | 1% |

| Exceeding RM7,500,000.00 | Subject to negotiation on the excess but shall not exceed 1% of such excess |

Understanding the Legal Fees

- For the first RM500,000: When the purchase price or adjudicated value of the property is up to RM500,000, the legal fee is calculated at 1.25% of that amount. However, there is a minimum fee of RM500.00, which means that even if 1.25% of the purchase price is less than RM500.00, you will still need to pay a minimum fee of RM500.00.

- Subsequent RM7,000,000.00: If the property’s value exceeds RM500,000.00, but it is less than or equal to RM7,000,000.00, the legal fee is a flat 1% of the purchase price.

- Exceeding RM7,500,000.00: For properties valued above RM7,500,000.00, the legal fee is subject to negotiation on the excess amount. However, it should not exceed 1% of the excess value.

Stamp Duty for Sale and Purchase Agreements / Transfers of Property

In addition to legal fees, stamp duty is another significant cost associated with property transactions. Stamp duty is calculated based on the purchase price or adjudicated value of the property. Here’s a breakdown of stamp duty rates:

| Purchase Price or Adjudicated Value | Scale of Adjudicated |

|---|---|

| First RM 100,000 | 1% |

| RM 100,001 to 500,000 | 2% |

| RM 500,001 to RM1,000,000 | 3% |

| Above RM1,000,000 | 4% |

Understanding Stamp Duty

- First RM 100,000: The stamp duty rate for the first RM 100,000 of the purchase price is 1%.

- RM 100,001 to 500,000: For the portion of the purchase price between RM 100,001 and RM 500,000, the stamp duty rate is 2%.

- RM 500,001 to RM1,000,000: If the property’s value falls between RM 500,001 and RM 1,000,000, the stamp duty rate is 3%.

- Above RM1,000,000: Properties with a purchase price exceeding RM 1,000,000 are subject to a stamp duty rate of 4%.

Putting It All Together

To better understand how legal fees and stamp duty work, let’s consider an example:

Suppose you are purchasing a property with an adjudicated value of RM800,000. Here’s how you would calculate the legal fees and stamp duty:

Legal Fees:

- For the first RM500,000, the fee is 1.25% or RM6,250.00 (subject to a minimum of RM500.00).

- The subsequent RM300,000 is charged at 1%, which amounts to RM3,000.00.

- The total legal fee is RM6,250.00 + RM3,000.00 = RM9,250.00.

Stamp Duty:

- The first RM100,000 is charged at 1%, which amounts to RM1,000.00.

- The remaining RM700,000 falls within the range of RM 100,001 to RM 500,000, and is charged at 2%, which amounts to RM14,000.00.

- The total stamp duty is RM1,000.00 + RM14,000.00 = RM15,000.00.

Conclusion

Understanding the legal fees and stamp duty calculations for property transactions in Malaysia is crucial for both buyers and sellers. These fees can significantly impact the overall cost of the transaction.

It’s important to be aware of the rates and how they apply to your specific situation. Consulting with a legal expert or a real estate professional can also provide valuable guidance during the process.

Remember that property transactions involve legal and financial aspects, and being well-informed can help you make the best decisions for your investment.

Related post: