Halopesa Tariffs 2023; Halopesa is a mobile money service offered by Halotel that enables customers to send and receive money quickly, safely, affordably, and conveniently 24/7. With the recent changes in Halopesa tariffs in 2023, customers are eager to learn more about the new structure and how it will impact their transactions.

The new Halopesa tariffs structure includes charges applicable when sending and receiving money for HaloPesa subscribers. Customers can now send and receive money in real-time, anytime, anywhere in Tanzania. The new tariffs are designed to make it easier for customers to securely and quickly send money to other Halotel customers. However, some customers may be concerned about the impact of the new tariffs on their transactions and whether they will be able to afford them.

Key Takeaways

- Halopesa is a mobile money service offered by Halotel that enables customers to send and receive money quickly, safely, affordably, and conveniently 24/7.

- The new Halopesa tariffs structure includes charges applicable when sending and receiving money for HaloPesa subscribers, designed to make it easier for customers to securely and quickly send money to other Halotel customers.

- Customers may be concerned about the impact of the new tariffs on their transactions and whether they will be able to afford them.

Overview of Halopesa Tariffs 2023

Halopesa is a mobile money service that allows customers to send and receive money quickly, safely, affordably, and conveniently 24/7. As with any financial service, Halopesa charges its customers fees for using its services. The fees charged by Halopesa are known as tariffs or transaction charges.

Halopesa has updated its tariffs for 2023, and customers should be aware of the new charges. The new tariffs apply to all Halopesa transactions, including sending and receiving money, buying airtime, and paying bills.

The tariffs for sending and receiving money depend on the amount of money being sent or received. For transactions up to TZS 50,000, the fee is TZS 100. For transactions between TZS 50,001 and TZS 100,000, the fee is TZS 200. For transactions between TZS 100,001 and TZS 500,000, the fee is TZS 500. For transactions between TZS 500,001 and TZS 1,000,000, the fee is TZS 1000. For transactions above TZS 1,000,000, the fee is TZS 2000.

In addition to the fees for sending and receiving money, Halopesa also charges fees for buying airtime and paying bills. The fees for buying airtime depend on the amount of airtime being purchased. For airtime purchases up to TZS 5000, the fee is TZS 50. For airtime purchases between TZS 5001 and TZS 10,000, the fee is TZS 100. For airtime purchases between TZS 10,001 and TZS 20,000, the fee is TZS 200. For airtime purchases above TZS 20,000, the fee is TZS 500.

The fees for paying bills depend on the type of bill being paid. For water bills, the fee is TZS 100. For electricity bills, the fee is TZS 500. For TV bills, the fee is TZS 200. For school fees, the fee is TZS 100.

Customers should be aware that these fees are subject to change, and they should check with Halopesa for the latest tariffs. Overall, Halopesa’s tariffs are competitive and affordable, making it a convenient option for customers who need to send or receive money, buy airtime, or pay bills.

Understanding Halopesa

Halopesa is a mobile money service that allows users to make payments, transfer money, and buy airtime. It is a product of Halotel, which is a telecommunications company in Tanzania. The service is available to anyone with a Halotel SIM card, and it can be accessed by dialing 15088#.

Halopesa charges tariffs for its services, which are subject to change. These tariffs apply to various transactions such as sending money, withdrawing cash, and paying bills. The tariffs are designed to be affordable and accessible to everyone, especially those in rural areas.

To use Halopesa, users must first register and create a PIN. Once registered, they can access the service through their mobile phones. The service is available 24/7, and users can make transactions at any time of the day.

Halopesa offers a range of services, including government payments, online payments, and merchant payments. Users can pay bills, buy goods and services, and transfer money to other Halopesa users. The service also allows users to withdraw cash from authorized agents.

In conclusion, Halopesa is a mobile money service that provides affordable and accessible financial services to users in Tanzania. It offers a range of services, including bill payments, money transfers, and online payments. The service is available 24/7 and can be accessed through mobile phones. Users must register and create a PIN to use the service.

Halopesa Tariffs Structure

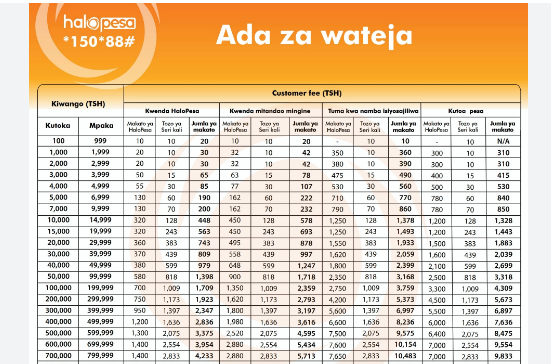

Halopesa is a mobile money service provider in Tanzania that offers its users a convenient and reliable way to send and receive money. The company has a transparent tariff structure that outlines the fees charged for various transactions. Here is a breakdown of the Halopesa tariffs for 2023:

Sending Money

Halopesa charges a fee for sending money to other Halopesa users and non-Halopesa users. The fees are as follows:

- Sending money to other Halopesa users is free of charge.

- Sending money to non-Halopesa users attracts a fee of 1% of the transaction amount.

Receiving Money

Receiving money through Halopesa is free of charge. However, the recipient may incur charges when withdrawing the money from an agent or ATM.

Cash Withdrawal

Halopesa users can withdraw cash from agents or ATMs. The fees for cash withdrawal are as follows:

- Withdrawal from an agent using a Halopesa wallet is free of charge.

- Withdrawal from an ATM using a Halopesa wallet attracts a fee of TZS 500.

Other Charges

Halopesa also charges fees for other services such as bill payments and airtime purchases. The fees for these services vary depending on the service provider.

It is important to note that the above fees are subject to change without prior notice. Users are advised to check the Halopesa website or contact customer care for the latest tariffs.

In summary, Halopesa offers a transparent tariff structure that makes it easy for users to understand the fees charged for various transactions. The company’s fees are competitive and in line with industry standards.

Impact of Halopesa Tariffs

Halopesa tariffs for 2023 have had a significant impact on the cost of using the mobile money service. The new tariffs have been implemented to reflect the increasing costs of providing the service and to ensure the sustainability of the Halopesa platform.

One of the most significant impacts of the Halopesa tariffs is the increase in the cost of transferring money. Customers will now have to pay more to send money to their friends and family, which may discourage some people from using the service. However, it is important to note that the new tariffs are still competitive compared to other mobile money services in Tanzania.

Another impact of the Halopesa tariffs is the increase in the cost of paying bills using the service. Customers will now have to pay more to use Halopesa to pay their bills, including government payments. However, the convenience of being able to pay bills using a mobile phone is still a significant advantage of the Halopesa platform.

Overall, the impact of the Halopesa tariffs will depend on the individual user and their specific needs. While some customers may find the new tariffs to be a burden, others may be willing to pay the increased fees for the convenience and security of using the Halopesa platform. It is important for customers to carefully consider their options and choose the mobile money service that best meets their needs and budget.

| Tariff | Previous | New |

|---|---|---|

| Transfer to another HaloPesa Customer | TZS 100 | TZS 150 |

| Transfer to a Non-HaloPesa Customer | TZS 500 | TZS 550 |

| Pay Bill | TZS 50 | TZS 100 |

Table: Comparison of previous and new Halopesa tariffs for selected services.

Changes in Halopesa Tariffs 2023

Halopesa, a mobile money service provider in Tanzania, has made some changes to its tariffs in 2023. These changes affect the fees charged for sending and receiving money, as well as the government levy.

The new tariffs are as follows:

| Transaction Type | Old Tariff | New Tariff |

|---|---|---|

| Sending Money to Other Halopesa Users | 0-5,000 TZS: 150 TZS <br> 5,001-10,000 TZS: 200 TZS <br> 10,001-20,000 TZS: 250 TZS <br> 20,001-50,000 TZS: 350 TZS <br> 50,001-100,000 TZS: 500 TZS <br> 100,001-200,000 TZS: 750 TZS <br> 200,001-300,000 TZS: 1,000 TZS <br> 300,001-400,000 TZS: 1,250 TZS <br> 400,001-500,000 TZS: 1,500 TZS <br> 500,001-600,000 TZS: 1,750 TZS <br> 600,001-700,000 TZS: 2,000 TZS <br> 700,001-800,000 TZS: 2,250 TZS <br> 800,001-900,000 TZS: 2,500 TZS <br> 900,001-1,000,000 TZS: 2,750 TZS | 0-5,000 TZS: 100 TZS <br> 5,001-10,000 TZS: 150 TZS <br> 10,001-20,000 TZS: 200 TZS <br> 20,001-50,000 TZS: 300 TZS <br> 50,001-100,000 TZS: 450 TZS <br> 100,001-200,000 TZS: 700 TZS <br> 200,001-300,000 TZS: 900 TZS <br> 300,001-400,000 TZS: 1,100 TZS <br> 400,001-500,000 TZS: 1,300 TZS <br> 500,001-600,000 TZS: 1,500 TZS <br> 600,001-700,000 TZS: 1,700 TZS <br> 700,001-800,000 TZS: 1,900 TZS <br> 800,001-900,000 TZS: 2,100 TZS <br> 900,001-1,000,000 TZS: 2,300 TZS |

| Sending Money to Non-Halopesa Users | 0-5,000 TZS: 300 TZS <br> 5,001-10,000 TZS: 400 TZS <br> 10,001-20,000 TZS: 500 TZS <br> 20,001-50,000 TZS: 700 TZS <br> 50,001-100,000 TZS: 1,000 TZS <br> 100,001-200,000 TZS: 1,500 TZS <br> 200,001-300,000 TZS: 2,000 TZS <br> 300,001-400,000 TZS: 2,500 TZS <br> 400,001-500,000 TZS: 3,000 TZS <br> 500,001-600,000 TZS: 3,500 TZS <br> 600,001-700,000 TZS: 4,000 TZS <br> 700,001-800,000 TZS: 4,500 TZS <br> 800,001-900,000 TZS: 5,000 TZS <br> 900,001-1,000,000 TZS: 5,500 TZS | 0-5,000 TZS: 250 TZS <br> 5,001-10,000 TZS: 350 TZS <br> 10,001-20,000 TZS: 450 TZS <br> 20,001-50,000 TZS: 600 TZS <br> 50,001-100,000 TZS: 850 TZS <br> 100,001-200,000 TZS |

Comparison with Previous Years

Halopesa tariffs have been subject to changes over the years, and it is essential to understand these changes to make informed decisions. Here is a brief comparison of Halopesa tariffs for the years 2021, 2022, and 2023.

Halopesa Tariffs in 2021

In 2021, Halopesa introduced new tariffs that were slightly higher than the previous year. The transaction fee for sending money from Halopesa to other mobile money users was 1.5% of the transaction value, with a minimum of TZS 500 and a maximum of TZS 10,000. The transaction fee for withdrawing cash from Halopesa agents was 1.5% of the transaction value, with a minimum of TZS 500 and a maximum of TZS 10,000.

Halopesa Tariffs in 2022

In 2022, Halopesa revised its tariffs, reducing the transaction fee for sending money to other mobile money users to 1% of the transaction value, with a minimum of TZS 500 and a maximum of TZS 10,000. The transaction fee for withdrawing cash from Halopesa agents remained the same as in the previous year.

Halopesa Tariffs in 2023

In 2023, Halopesa has maintained the transaction fee for sending money to other mobile money users at 1% of the transaction value, with a minimum of TZS 500 and a maximum of TZS 10,000. However, the transaction fee for withdrawing cash from Halopesa agents has been increased to 1.5% of the transaction value, with a minimum of TZS 500 and a maximum of TZS 10,000.

Overall, Halopesa tariffs have remained relatively stable over the years, with minor changes made to the transaction fees. Customers can use the Halopesa app or dial 15088# to access the tariffs and make transactions.

Halopesa Tariffs Analysis

Halopesa is a mobile money service provider in Tanzania that offers affordable and convenient financial services to its customers. As of 2023, Halopesa has updated its transaction tariffs to provide better value to its users.

Transaction Fees

Halopesa charges transaction fees for sending and receiving money, as well as for cash withdrawals. The transaction fees are based on the amount of money being transferred and the type of transaction being conducted.

For example, for transactions between TZS 1 and TZS 5,000, Halopesa charges TZS 50. For transactions between TZS 5,001 and TZS 30,000, Halopesa charges TZS 100. For transactions between TZS 30,001 and TZS 100,000, Halopesa charges TZS 200.

Cash Withdrawal Fees

Halopesa charges a cash withdrawal fee for customers who want to withdraw cash from their Halopesa account. The cash withdrawal fee is based on the amount of money being withdrawn.

For example, for cash withdrawals between TZS 1 and TZS 5,000, Halopesa charges TZS 50. For cash withdrawals between TZS 5,001 and TZS 30,000, Halopesa charges TZS 100. For cash withdrawals between TZS 30,001 and TZS 100,000, Halopesa charges TZS 200.

International Money Transfer Fees

Halopesa also offers international money transfer services to its customers. The fees for international money transfers are based on the amount of money being transferred and the destination country.

For example, for international money transfers between TZS 1 and TZS 5,000 to Kenya, Halopesa charges TZS 100. For international money transfers between TZS 5,001 and TZS 30,000 to Kenya, Halopesa charges TZS 200. For international money transfers between TZS 30,001 and TZS 100,000 to Kenya, Halopesa charges TZS 400.

Overall, Halopesa’s updated transaction tariffs provide affordable and convenient financial services to its customers.

Future Predictions for Halopesa Tariffs

As the world continues to evolve, it is expected that Halopesa tariffs will also change in the future. Here are some predictions for the future of Halopesa tariffs:

Increase in Tariffs

One prediction is that Halopesa tariffs will increase in the future. This could be due to inflation, increased operational costs, or changes in government regulations. As Halopesa expands its services and reaches more customers, it may need to adjust its tariffs to remain profitable.

Introduction of New Tariff Plans

Halopesa may also introduce new tariff plans in the future to cater to different customer needs. For example, it may introduce a tariff plan for frequent users or a plan for users who only make occasional transactions. These new tariff plans could be designed to attract new customers and retain existing ones.

Tariffs for New Services

As Halopesa expands its services, it may also introduce tariffs for these new services. For example, if Halopesa introduces a new feature that allows customers to pay bills through the app, it may introduce tariffs for this service. This would allow Halopesa to generate revenue from new sources while providing added value to its customers.

Competition from Other Mobile Money Services

Finally, Halopesa may face increased competition from other mobile money services in the future. If this happens, Halopesa may need to adjust its tariffs to remain competitive. It may also need to introduce new features and services to attract and retain customers.

Overall, the future of Halopesa tariffs is uncertain, but it is clear that the company will need to adapt to changing market conditions and customer needs to remain competitive.

Conclusion

In 2023, Tanzania imposed tariffs on mobile money transactions, including those made through HaloPesa. The tariffs ranged from 0.1% to 10% depending on the transaction amount. While some users expressed frustration over the additional fees, the Tanzanian government argued that the tariffs were necessary to boost revenue and reduce reliance on foreign aid.

Despite the tariffs, HaloPesa remains a popular choice for mobile money transactions in Tanzania. The service offers a variety of features and benefits, including bill payments, airtime top-ups, and cash withdrawals. Additionally, HaloPesa has partnered with several banks and businesses to expand its reach and improve its services.

While it is unclear whether the tariffs will have a significant impact on HaloPesa’s business, the company has stated that it will continue to work with the Tanzanian government to find a mutually beneficial solution. As mobile money continues to grow in popularity in Tanzania and other countries, it is likely that similar debates over tariffs and fees will arise. However, with the right partnerships and innovative solutions, companies like HaloPesa can continue to thrive and provide valuable services to users.

Frequently Asked Questions

How do I download and install the HaloPesa app?

To download and install the HaloPesa app, simply visit the Google Play Store or Apple App Store and search for “HaloPesa”. Once you find the app, click on the “Install” button and follow the on-screen instructions to complete the installation process.

What are the new tariffs for HaloPesa in 2023?

The new tariffs for HaloPesa in 2023 are available on the official HaloPesa website. The tariffs are subject to change, so it is recommended to check the website regularly for updates.

How do I link my HaloPesa Visa card to my account?

To link your HaloPesa Visa card to your account, log in to your HaloPesa account and click on the “Link Card” button. Follow the on-screen instructions to complete the process. If you encounter any issues, contact HaloPesa customer service for assistance.

Can I transfer money from HaloPesa to a bank account?

Yes, you can transfer money from your HaloPesa account to a bank account. To do so, log in to your HaloPesa account and click on the “Transfer” button. Follow the on-screen instructions to complete the process.

What is the customer service number for HaloPesa?

The customer service number for HaloPesa is available on the official HaloPesa website. You can also contact customer service through the HaloPesa app or by sending an email to the provided email address.

How do I check my HaloPesa account balance?

To check your HaloPesa account balance, log in to your HaloPesa account and click on the “Balance” button. Your account balance will be displayed on the screen.

Also read:

Leave a Reply

View Comments